Free TCO Calculator + Complete Guide (2026)

Use our free TCO calculator to compare vendor costs. Includes the TCO formula, hidden cost checklist, and real industry examples.

SpecLens Team

Procurement & AI Experts

Why Total Cost of Ownership Matters in Procurement

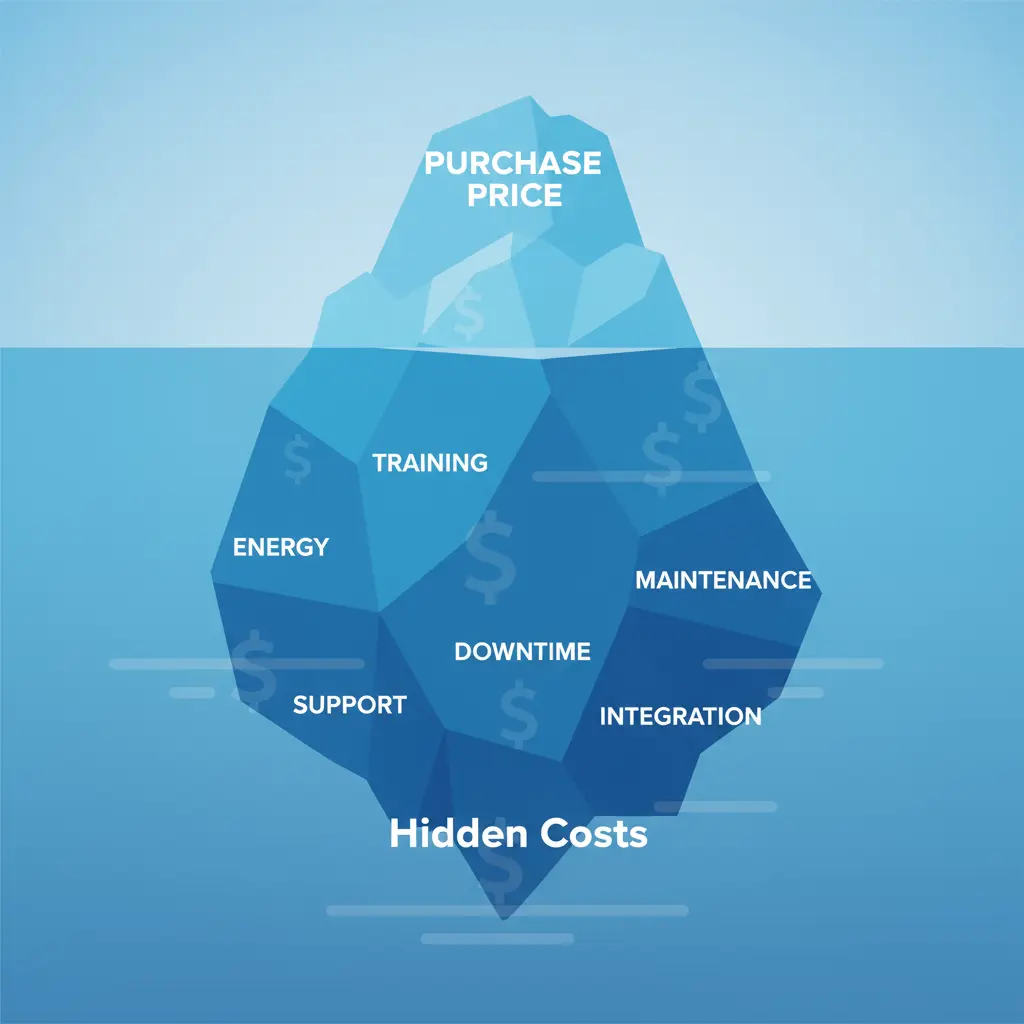

When evaluating equipment purchases, the sticker price is just the beginning. Hidden costs—maintenance, training, energy consumption, downtime, and eventual disposal—can double or triple your initial investment. This is why understanding Total Cost of Ownership (TCO) is critical for making smart procurement decisions.

Studies show that in 2026, organizations focusing only on purchase price end up spending 40-60% more over the equipment's lifetime compared to those who calculate TCO. Whether you're procuring IT infrastructure, manufacturing equipment, construction machinery, or healthcare devices, TCO analysis ensures you're making financially sound decisions. For IT infrastructure specifically, see our Cloud vs. On-Premise guide.

What is Total Cost of Ownership (TCO)?

Total Cost of Ownership is a comprehensive financial analysis that calculates the complete lifecycle cost of acquiring, operating, maintaining, and disposing of equipment or services. Unlike simple price comparison, TCO considers:

- Acquisition costs: Purchase price, shipping, installation

- Operating costs: Energy, consumables, labor

- Maintenance costs: Repairs, spare parts, service contracts

- Indirect costs: Training, downtime, opportunity costs

- End-of-life costs: Disposal, recycling, decommissioning

The Hidden Costs Most Organizations Overlook

Many procurement teams underestimate or completely ignore these critical cost components:

1. Training and Learning Curve Costs

New equipment requires training. Factor in:

- Formal training programs (vendor-led or third-party)

- Staff time during training (lost productivity)

- Reduced efficiency during the learning period (typically 3-6 months)

- Ongoing training for new employees

Real Example: A manufacturing company purchased CNC equipment for $200,000 but spent an additional $35,000 on training and lost $50,000 in productivity during the ramp-up period. These costs weren't in their original budget.

2. Integration and Compatibility Costs

Equipment rarely works standalone. Integration costs include:

- Custom software development or middleware

- System upgrades to ensure compatibility

- Consulting fees for complex integrations

- Testing and validation

3. Downtime and Opportunity Costs

When equipment fails, you lose more than repair costs:

- Direct downtime costs: Lost production or service capacity

- Indirect costs: Customer dissatisfaction, missed deadlines

- Emergency repair premiums: Rush shipping, overtime labor

- Reputation damage: Difficult to quantify but very real

Case Study: A hospital's MRI machine failure cost $15,000 in repairs but resulted in $120,000 in lost revenue from rescheduled appointments and patients going to competitors.

4. Energy and Environmental Costs

Operating costs vary dramatically between equipment:

- Electricity consumption

- Cooling requirements (especially for IT equipment)

- Consumables (toner, filters, lubricants)

- Environmental compliance and carbon taxes (increasingly common)

A server that costs $5,000 less upfront but consumes 30% more power will cost thousands more over its 5-year lifespan.

5. Upgrade and Scalability Costs

Future-proofing isn't free:

- Software upgrades and license renewals

- Hardware expansion (memory, storage, capacity)

- Technology refresh cycles

- Migration costs when eventually replacing equipment

The Complete TCO Calculation Framework

Use this comprehensive framework to calculate TCO for any equipment purchase:

Phase 1: Acquisition Costs (Year 0)

Purchase Price Components:

- Base equipment price

- Optional features and upgrades

- Volume discounts (if applicable)

- Sales tax and import duties

Initial Setup Costs:

- Shipping and freight

- Installation and commissioning

- Site preparation (electrical, ventilation, space modifications)

- Initial training

- Configuration and customization

- Testing and validation

Formula:

Acquisition Cost = Purchase Price + Setup Costs + Initial Training

Phase 2: Operating Costs (Annual)

Direct Operating Costs:

- Energy consumption: kWh × unit cost × hours operated

- Consumables: Supplies needed for operation

- Labor: Operator time and wages

- Insurance: Equipment-specific coverage

Indirect Operating Costs:

- Space costs (rent, climate control)

- Security and access control

- Monitoring and management systems

Formula:

Annual Operating Cost = Energy + Consumables + Labor + Insurance + Space

Phase 3: Maintenance Costs (Annual)

Preventive Maintenance:

- Scheduled service intervals

- Replacement parts (filters, belts, wear items)

- Service contracts or warranties

- Internal maintenance labor

Corrective Maintenance:

- Average annual repair costs (use vendor or industry data)

- Emergency service callouts

- Unplanned spare parts

- Downtime costs

Formula:

Annual Maintenance Cost = Preventive Maintenance + (Estimated Failures × Repair Cost)

Phase 4: Support and Management Costs (Annual)

Technical Support:

- Vendor support contracts

- Help desk or internal support costs

- Software updates and patches

- Documentation and knowledge base maintenance

Management and Administration:

- Asset tracking and inventory management

- Compliance reporting

- Performance monitoring

- Auditing and documentation

Phase 5: Disposal Costs (End of Life)

Decommissioning:

- Equipment removal and transportation

- Data sanitization (for IT equipment)

- Environmental remediation (if needed)

Disposal or Resale:

- Recycling fees

- Disposal costs (may be negative if resale value exists)

- Documentation and certificates of destruction

The TCO Calculation Formula

Put it all together with this comprehensive formula:

Total Cost of Ownership Formula:

TCO = Acquisition Costs + (Annual Operating Costs × Years) + (Annual Maintenance Costs × Years) + (Annual Support Costs × Years) + Disposal Costs - Residual Value

Where:

- • Years = Expected equipment lifespan

- • Residual Value = Estimated resale or salvage value at end of life

- • All costs should be adjusted for inflation/discount rate if analyzing over 5+ years

TCO Calculator Template: Step-by-Step Guide

Here's how to build a practical TCO calculator spreadsheet:

Step 1: Define Your Analysis Parameters

- Analysis period: Typically 3-5 years for technology, 5-10 years for industrial equipment

- Discount rate: Your organization's cost of capital (typically 5-10%)

- Currency: Ensure all costs use the same currency

Step 2: Create Input Sections

Build a spreadsheet with these sections:

TCO Calculator Template Structure

Section A: Acquisition Costs

- • Purchase price: $______

- • Shipping/freight: $______

- • Installation: $______

- • Initial training: $______

- • Configuration: $______

- • Total Acquisition: $______

Section B: Annual Operating Costs

- • Energy (kWh × rate × hours): $______/year

- • Consumables: $______/year

- • Labor: $______/year

- • Insurance: $______/year

- • Space costs: $______/year

- • Total Annual Operating: $______/year

Section C: Annual Maintenance Costs

- • Preventive maintenance: $______/year

- • Service contracts: $______/year

- • Estimated repairs: $______/year

- • Downtime costs: $______/year

- • Total Annual Maintenance: $______/year

Section D: Annual Support Costs

- • Technical support: $______/year

- • Software updates: $______/year

- • Training (ongoing): $______/year

- • Management overhead: $______/year

- • Total Annual Support: $______/year

Section E: Disposal Costs

- • Decommissioning: $______

- • Recycling/disposal: $______

- • Less: Estimated resale value: ($______)

- • Net Disposal Cost: $______

Section F: TCO Summary

- • Year 0 (Acquisition): $______

- • Years 1-N (Operating): $______ × __ years = $______

- • Years 1-N (Maintenance): $______ × __ years = $______

- • Years 1-N (Support): $______ × __ years = $______

- • Year N (Disposal): $______

- • TOTAL COST OF OWNERSHIP: $______

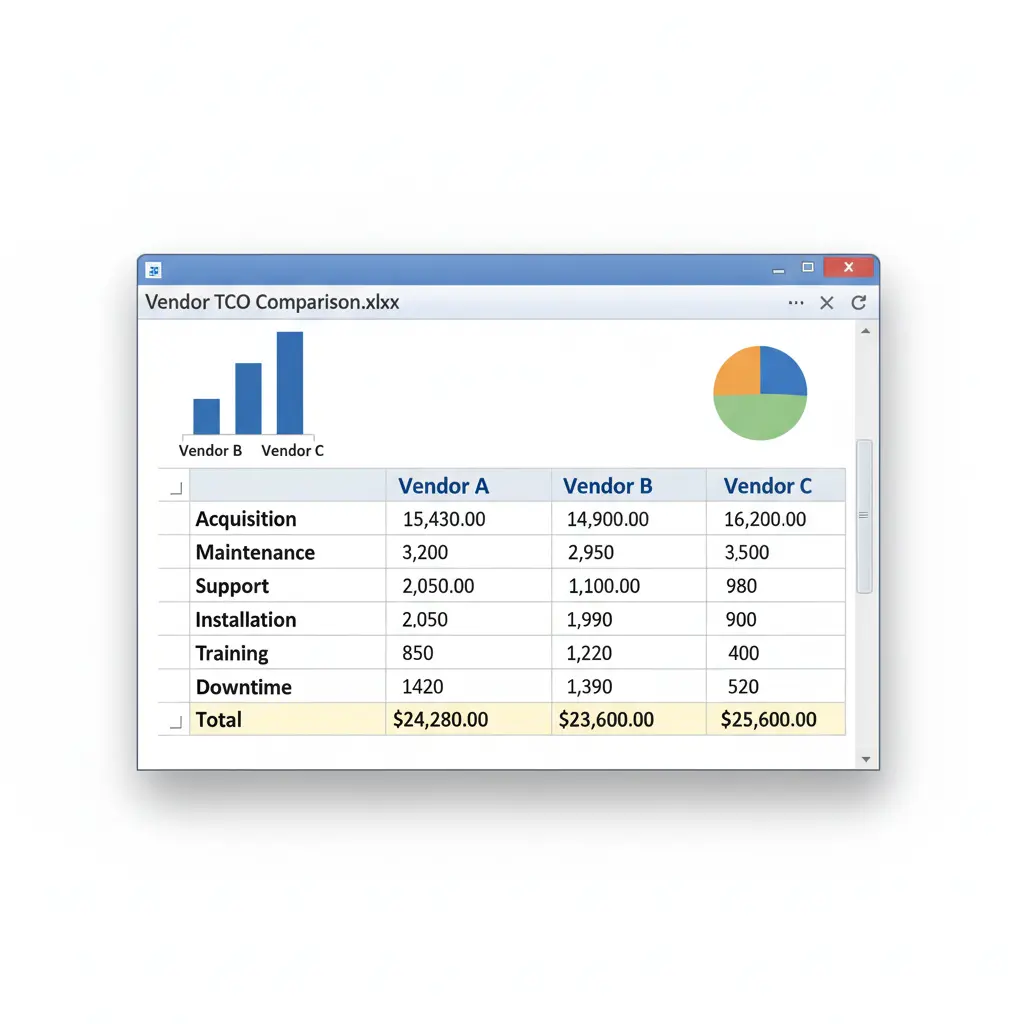

Step 3: Add Comparison Features

Create multiple columns to compare different vendors or equipment options side by side:

- Option A (Vendor 1)

- Option B (Vendor 2)

- Option C (Vendor 3)

Include summary metrics:

- Total TCO: Complete lifecycle cost

- Annual TCO: Total TCO ÷ years of service

- TCO per unit: If measuring productivity (e.g., TCO per server, per product manufactured)

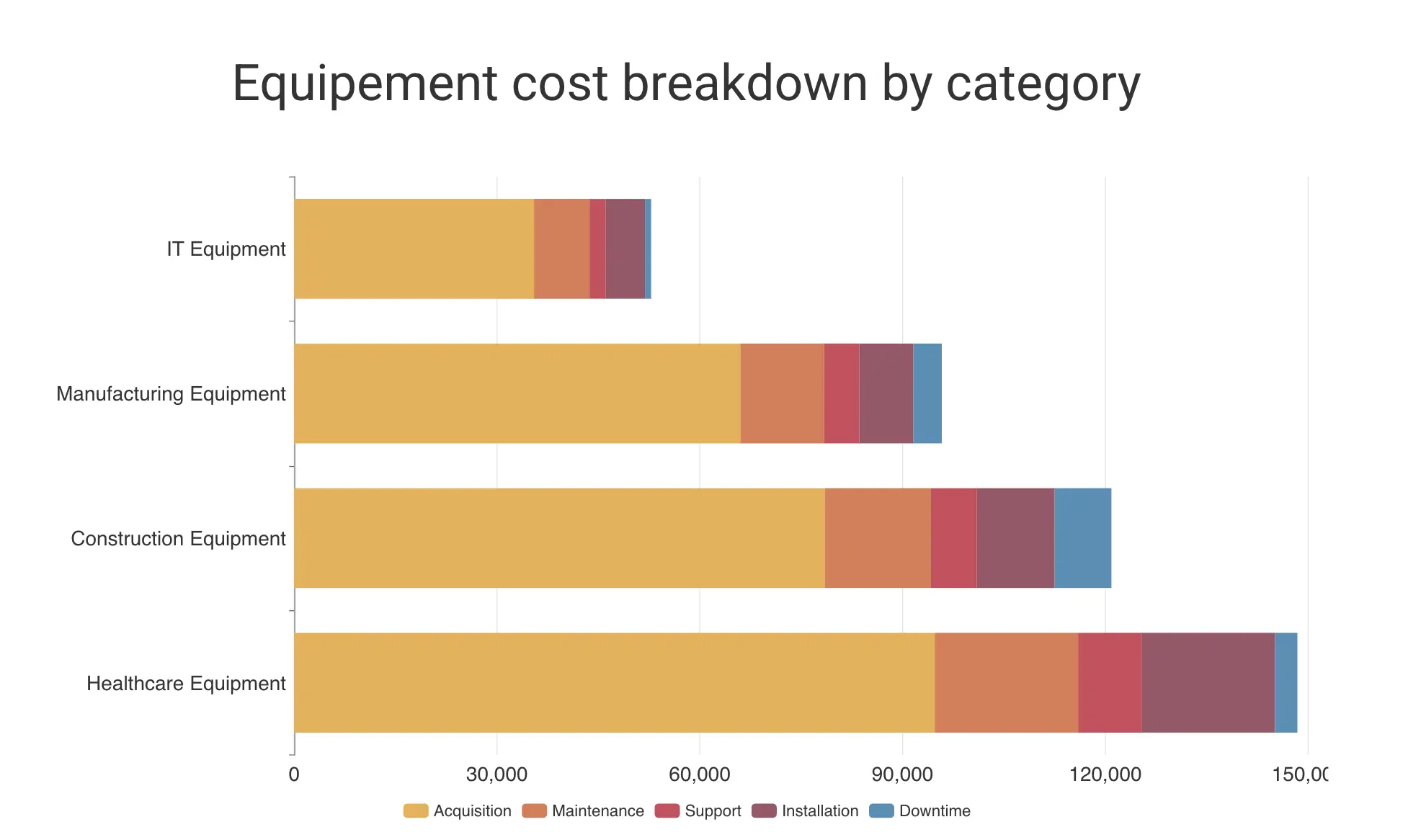

Industry-Specific TCO Examples

IT Equipment TCO Example: Server Procurement

Scenario: Comparing two server options for a 5-year lifecycle.

| Cost Component | Vendor A (Low Price) | Vendor B (Premium) |

|---|---|---|

| Acquisition | ||

| Purchase price | $15,000 | $22,000 |

| Setup & installation | $2,000 | $1,500 |

| Annual Operating | ||

| Energy (higher power draw) | $3,200/year | $2,100/year |

| Cooling | $1,200/year | $800/year |

| Annual Maintenance | ||

| Service contract | $1,800/year | $2,400/year |

| Estimated repairs | $1,200/year | $400/year |

| Downtime costs | $2,000/year | $500/year |

| 5-Year TCO | $63,000 | $53,000 |

Result: Despite Vendor A's lower purchase price ($15K vs $22K), Vendor B's superior reliability and efficiency result in $10,000 lower TCO over 5 years—a 16% savings.

Manufacturing Equipment TCO Example: CNC Machine

Scenario: Two CNC machines with 10-year lifecycles.

- Option A: $180,000 purchase, high maintenance, lower productivity

- Option B: $240,000 purchase, low maintenance, 20% higher productivity

TCO Analysis Results:

- Option A TCO: $450,000 (10 years)

- Option B TCO: $420,000 (10 years)

- Option B also produces 20% more parts, increasing revenue by $150,000 over 10 years

Total Advantage: Option B provides $180,000 better value ($30K TCO savings + $150K additional revenue).

Construction Equipment TCO Example: Excavator Purchase vs Lease

Scenario: 5-year comparison of buying vs leasing an excavator.

Purchase Option:

- Purchase price: $320,000

- Maintenance: $18,000/year

- Fuel: $22,000/year

- Insurance: $8,000/year

- Resale after 5 years: -$120,000

- 5-Year TCO: $440,000

Lease Option:

- Monthly lease: $6,500 × 60 months = $390,000

- Fuel: $22,000/year = $110,000

- Maintenance included in lease: $0

- Insurance included: $0

- 5-Year TCO: $500,000

Result: Purchasing saves $60,000 over 5 years, but leasing provides flexibility and predictable costs.

Advanced TCO Considerations

1. Time Value of Money (Net Present Value)

For multi-year analyses, account for the time value of money using Net Present Value (NPV):

NPV = Cost ÷ (1 + discount rate)^year

Example: A $10,000 cost in year 5 with a 7% discount rate has a present value of $7,130.

2. Risk and Uncertainty Analysis

Add contingency factors for uncertain costs:

- Best case: Optimistic cost estimates (80% of expected)

- Most likely: Expected costs (100%)

- Worst case: Pessimistic estimates (130% of expected)

Use weighted averages: (Best × 0.25) + (Most Likely × 0.50) + (Worst × 0.25)

3. Sensitivity Analysis

Test how changes in key variables affect TCO:

- What if energy costs increase 20%?

- What if equipment lasts 7 years instead of 5?

- What if maintenance costs are 30% higher than estimated?

This identifies which cost factors have the biggest impact on your decision.

4. Productivity and Revenue Impact

Don't forget the revenue side:

- Throughput differences: Faster equipment produces more revenue

- Quality improvements: Fewer defects reduce waste costs

- Capacity: Higher capacity allows serving more customers

Formula:

Total Value = TCO + Revenue/Productivity Impact

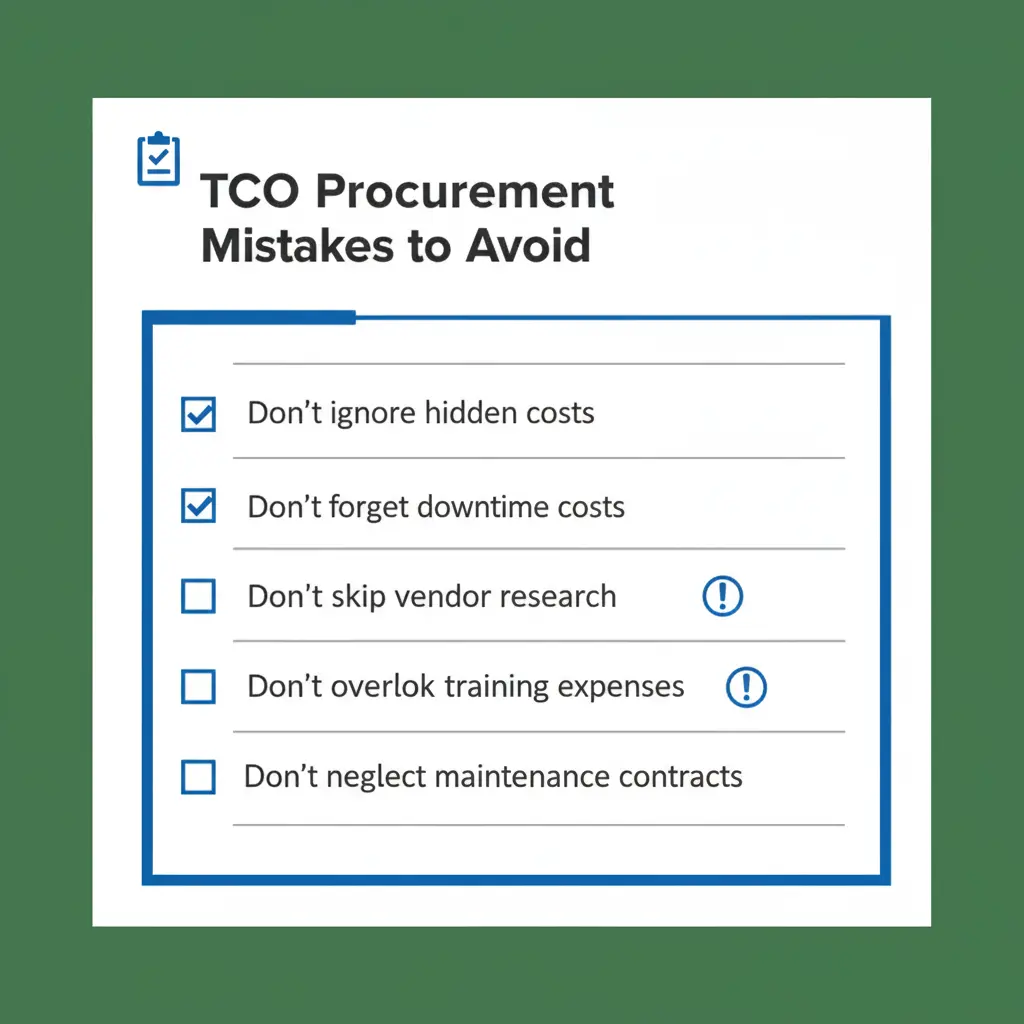

Common TCO Calculation Mistakes to Avoid

1. Focusing Only on Obvious Costs

Mistake: Including only purchase price and basic maintenance.

Fix: Use the comprehensive framework above—account for ALL cost categories.

2. Ignoring Vendor-Specific Factors

Mistake: Assuming all vendors have similar support quality.

Fix: Research vendor reliability, support responsiveness, and part availability. A vendor with poor support will cost more long-term.

3. Using Incorrect Time Horizons

Mistake: Comparing 3-year TCO for equipment that lasts 8 years.

Fix: Use realistic lifecycles based on industry standards and vendor specifications.

4. Not Adjusting for Inflation

Mistake: Using today's costs for expenses 5 years from now.

Fix: Apply inflation adjustments (typically 2-3% annually) to future costs.

5. Forgetting Opportunity Costs

Mistake: Not considering what else you could do with the capital.

Fix: Factor in your organization's cost of capital and alternative investment returns.

6. Overlooking Environmental and Regulatory Costs

Mistake: Ignoring carbon taxes, environmental compliance, and disposal regulations.

Fix: Research current and anticipated regulations—sustainability costs are increasing.

How AI and Automation Improve TCO Analysis

Modern procurement teams are using technology to make TCO calculations faster and more accurate:

Automated Data Extraction

- AI reads vendor proposals and extracts cost data automatically

- Eliminates manual data entry errors and saves hours

- Normalizes units and formats across different vendors

Historical Cost Database

- Track actual costs from past procurements

- Improve estimates with real organizational data

- Identify cost trends and predict future expenses

Real-Time TCO Comparison

- Instant side-by-side TCO analysis of multiple vendors

- Visual dashboards showing cost breakdowns

- What-if scenarios to test different assumptions

Tools like SpecLens can extract pricing and specification data from vendor proposals automatically, feeding directly into TCO calculators. This reduces calculation time from days to minutes while improving accuracy. You can also use our ROI Calculator to estimate your savings from automation.

TCO Best Practices for Procurement Teams

1. Standardize Your TCO Template

Create organization-wide TCO templates for different equipment categories. This ensures:

- Consistency across procurement decisions

- Nothing is overlooked

- Easy comparison of historical data

2. Involve Cross-Functional Teams

Get input from:

- Finance: Discount rates, capital budgeting rules

- Operations: Realistic operating cost estimates

- Maintenance: Expected repair and maintenance costs

- IT/Technical: Integration and compatibility considerations

- End users: Productivity and usability factors

3. Update TCO Assumptions Regularly

Review and update your TCO models:

- After each procurement to compare estimates vs actuals

- When energy or labor costs change significantly

- When new regulations or standards are introduced

4. Document Your Assumptions

Always record:

- Where cost estimates came from

- What assumptions were made

- Confidence level in each estimate

This allows future procurement teams to understand and improve the model.

5. Validate with Vendor References

Ask vendor references:

- "What were your actual operating costs?"

- "How much did you spend on maintenance?"

- "What unexpected costs did you encounter?"

Real user data is more accurate than vendor estimates.

6. Track Post-Purchase Performance

Monitor actual costs after purchase:

- Compare to TCO estimates

- Identify where estimates were off

- Improve future TCO calculations

Free TCO Calculator Spreadsheet Template

To help you get started, here's a summary of what your TCO calculator spreadsheet should include:

Essential Excel Features to Include:

- ✓ Input section with clearly labeled cost categories

- ✓ Multiple vendor columns for side-by-side comparison

- ✓ Automatic calculations using formulas

- ✓ Year-by-year breakdown showing costs over time

- ✓ NPV calculations with adjustable discount rate

- ✓ Charts and graphs visualizing TCO comparison

- ✓ Sensitivity analysis section for what-if scenarios

- ✓ Summary dashboard with key metrics highlighted

Pro Tip: Use data validation and dropdown lists to ensure consistent data entry across your team.

Conclusion: Making Smarter Procurement Decisions with TCO

Try Our Free TCO Calculator

Calculate the true Total Cost of Ownership for your procurement decisions. Include hidden costs like maintenance, training, and disposal.

Calculate TCO Now →Total Cost of Ownership analysis transforms procurement from price-focused to value-focused. By considering the complete lifecycle costs—acquisition, operation, maintenance, support, and disposal—you'll make decisions that save your organization significant money long-term.

Key takeaways:

- Purchase price is just 20-40% of total lifecycle costs

- Hidden costs (training, downtime, energy, maintenance) often exceed the purchase price

- TCO analysis consistently reveals that the cheapest option isn't the best value

- Standardized TCO templates ensure consistent, thorough analysis

- Cross-functional input improves accuracy and buy-in

- Technology and AI can automate much of the TCO calculation process

Organizations that adopt TCO-based procurement report 20-35% cost savings compared to price-only decision-making. The upfront effort of building TCO models pays for itself many times over.

Start with one equipment category, create a comprehensive TCO template, and refine it over time. Soon, TCO analysis will become second nature—and your procurement decisions will deliver significantly better value.

Ready to streamline your TCO analysis? SpecLens uses AI to automatically extract cost and specification data from vendor proposals, feeding directly into your TCO calculations. What used to take days now takes minutes. Try it free and make smarter procurement decisions faster.

Tags:

Related Articles

Compare Product Specifications (2026)

Master product specification comparison with proven strategies for vendor proposals and technical documents. Step-by-step guide for procurement teams.

How to Write an RFP: 2026 Guide

Complete RFP writing guide for 2026. Learn the 10 essential components, step-by-step process, and templates that get quality vendor responses.

Vendor Negotiation: 6 Strategies for 2026

Negotiate better deals with suppliers using these 6 proven strategies. Save costs, secure better terms, and build stronger vendor relationships.

15 Hidden Procurement Costs

Discover hidden procurement costs that blow your budget. Learn to identify installation, training, maintenance, and overlooked expenses.