Vendor Risk Assessment Framework

Protect your organization with systematic vendor risk assessment. Frameworks and checklist for financial, operational, and compliance risk.

SpecLens Team

Procurement & AI Experts

Every vendor relationship carries risk. The question isn't whether to accept risk—it's whether you understand the risks you're accepting and have appropriate controls in place.

This comprehensive guide provides a framework for systematic vendor risk assessment, covering all major risk categories with practical evaluation methods.

Why Vendor Risk Assessment Matters

The Risk Reality

Vendor failures create real problems:

| Vendor Issue | Business Impact |

|---|---|

| Financial instability | Service interruption, stranded investment |

| Quality problems | Defective products, rework, delays |

| Security breach | Data exposure, regulatory penalties |

| Compliance failure | Your liability, regulatory issues |

| Service interruption | Operations disruption |

| Relationship breakdown | Support gaps, hostile exit |

When Problems Are Discovered

| Assessment Timing | Consequence |

|---|---|

| Before selection | Choose different vendor; avoid problem |

| After selection, before contract | Exit with minimal loss |

| After contract, during relationship | Difficult to exit; manage the problem |

| After problem manifests | Damage done; recovery mode |

Key Principle: Earlier assessment = more options = less damage.

Assessment Depth by Vendor Type

| Vendor Type | Risk Level | Assessment Depth |

|---|---|---|

| Strategic suppliers | High | Deep assessment |

| Mission-critical services | High | Deep assessment |

| Significant spend | Medium-High | Full assessment |

| Routine suppliers | Medium | Standard assessment |

| Commodity, replaceable | Low | Basic assessment |

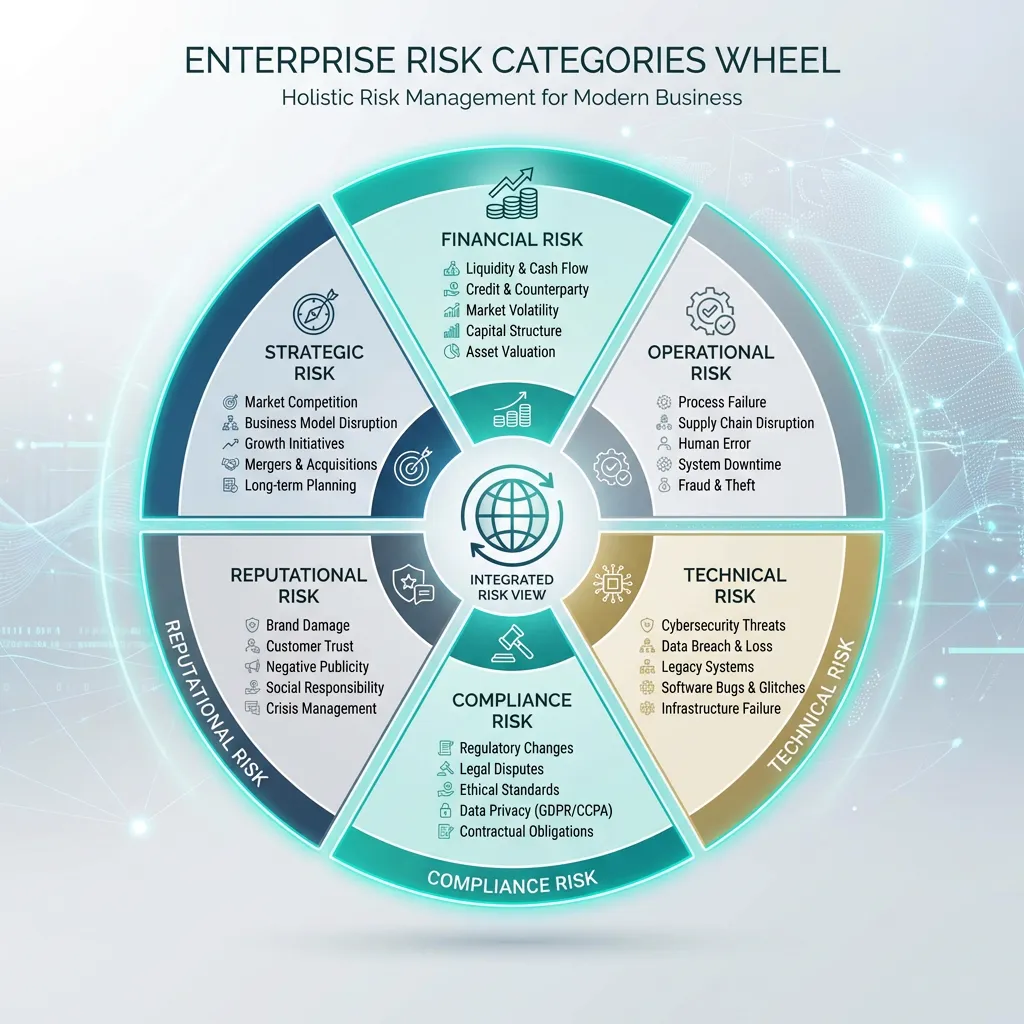

Risk Categories

Comprehensive vendor risk assessment covers multiple dimensions.

Financial Risk

Can the vendor survive and perform?

| Risk Factor | What to Assess | Why It Matters |

|---|---|---|

| Profitability | Are they making money? | Ability to invest and sustain |

| Cash flow | Can they fund operations? | Day-to-day ability to deliver |

| Debt levels | How leveraged are they? | Vulnerability to economic stress |

| Revenue trends | Growing, stable, or declining? | Long-term viability |

| Customer concentration | Dependent on few customers? | What if they lose major client? |

| Ownership stability | Private equity, transition? | Strategic direction stability |

Critical Financial Ratios to Check:

- Quick Ratio: (Current Assets - Inventory) / Current Liabilities. Ideally > 1.0. Indicates liquidity.

- Debt-to-Equity: High debt means high risk if interest rates rise or revenue dips.

- Altman Z-Score: A composite score that predicts bankruptcy risk.

Assessment sources: Financial statements (if available), credit reports (D&B, Experian), industry reputation, payment history, news and announcements.

Operational Risk

Can the vendor execute reliably?

| Risk Factor | What to Assess | Why It Matters |

|---|---|---|

| Capacity | Can they handle your volume? | Delivery capability |

| Quality systems | Do they have quality controls? | Product/service consistency |

| Key person dependence | Single points of failure? | Continuity if personnel change |

| Process maturity | Documented, repeatable processes? | Consistency and reliability |

| Subcontractor risk | Do they rely on others? | Hidden dependencies |

| Geographic risk | Location-specific vulnerabilities? | Natural disaster, political risk |

Assessment sources: Site visits, quality certifications (ISO, etc.), process documentation review, reference checks, performance history.

Geopolitical & Supply Chain Risk

In a globalized world, where your vendor sits matters as much as who they are.

Risks to evaluate:

- Trade Tariffs: Could a 20% tariff suddenly make this vendor unaffordable?

- Political Instability: Is their factory in a region prone to civil unrest or border closures?

- Labor Strikes: Is the local labor market volatile?

- Port Congestion: Do they ship through chokepoints?

Mitigation: Multi-sourcing from different geographic regions ("China + 1" or "Near-shoring").

Fourth-Party Risk (Subcontractors)

You vet your vendor (3rd party), but do you vet their vendors (4th party)?

The Danger: Your software vendor hosts their app on a budget cloud provider that gets hacked. You technically didn't hire the budget provider, but your data is still gone.

Questions to ask:

- "Who are your critical subcontractors?"

- "Do you audit them?"

- "Do you have backup providers if they fail?"

Technical Risk

Can the vendor meet technical requirements?

| Risk Factor | What to Assess | Why It Matters |

|---|---|---|

| Technology currency | Is technology current? | Obsolescence risk |

| Investment in R&D | Ongoing development? | Future capability |

| Technical expertise | Deep knowledge available? | Problem-solving ability |

| Integration capability | Can they connect to your systems? | Interoperability |

| Scalability | Can solution grow with you? | Future fit |

| Documentation | Is it well-documented? | Maintainability, transition |

Information Security Risk

Will they protect your data?

| Risk Factor | What to Assess | Why It Matters |

|---|---|---|

| Security certifications | SOC 2, ISO 27001? | External validation |

| Data handling practices | How is your data managed? | Confidentiality |

| Access controls | Who can access what? | Appropriate limitations |

| Incident history | Past breaches? | Track record |

| Security governance | Policies, procedures? | Organizational commitment |

| Subcontractor security | How are they managed? | Extended risk |

Compliance Risk

Will they meet regulatory obligations?

| Risk Factor | What to Assess | Why It Matters |

|---|---|---|

| Regulatory awareness | Do they understand requirements? | Applicable knowledge |

| Compliance history | Past violations? | Track record |

| Certification currency | Current certifications? | Ongoing compliance |

| Audit readiness | Can they demonstrate compliance? | Evidentiary capability |

| Contract terms | Do terms support compliance? | Contractual protection |

Reputational Risk

Could association damage your reputation?

| Risk Factor | What to Assess | Why It Matters |

|---|---|---|

| Media coverage | Negative press? | Public perception |

| ESG performance | Environmental, social, governance? | Stakeholder values |

| Legal history | Litigation, settlements? | Ethical concerns |

| Labor practices | Fair treatment? | Social responsibility |

| Industry reputation | How are they perceived? | Credibility by association |

Case Study: The Vendor Who Went Dark

⚠️ Real-World Example

The Scenario: A retail chain relied on a single vendor for Point-of-Sale (POS) paper rolls.

The Risk Assessment Miss: The procurement team checked the price ($0.05 cheaper per roll!) but skipped the financial health check because "it's just paper, it's not critical software."

The Incident: On November 15th—start of the holiday rush—the vendor's factory operations ceased. They had been operating on zero cash for months and couldn't pay their pulp supplier.

The Impact:

- Retail chain had 3 days of inventory

- Emergency sourcing from a competitor cost 3x the normal price + expedited air freight

- Total Loss: $250,000 in expedited costs (wiping out 5 years of "savings")

Lesson: Even "low tech" suppliers can be "high criticality" if they stop your operations. Financial health checks are mandatory for sole-source suppliers.

Risk Assessment Process

Step 1: Identify Criticality

Before assessing risk, understand how critical the vendor is:

| Criticality Factor | Questions |

|---|---|

| Business impact | What happens if they fail? |

| Replaceability | How hard to replace? |

| Spend level | How significant is the investment? |

| Data access | What data do they touch? |

| Customer-facing | Do they interact with your customers? |

| Regulatory scope | What compliance depends on them? |

Higher criticality = deeper assessment.

Step 2: Gather Information

| Source Type | Examples |

|---|---|

| Vendor-provided | Questionnaires, certifications, financials |

| Public records | Filings, news, court records |

| Third-party | Credit reports, ratings, industry reports |

| References | Customer interviews, industry contacts |

| Direct assessment | Site visits, demonstrations, testing |

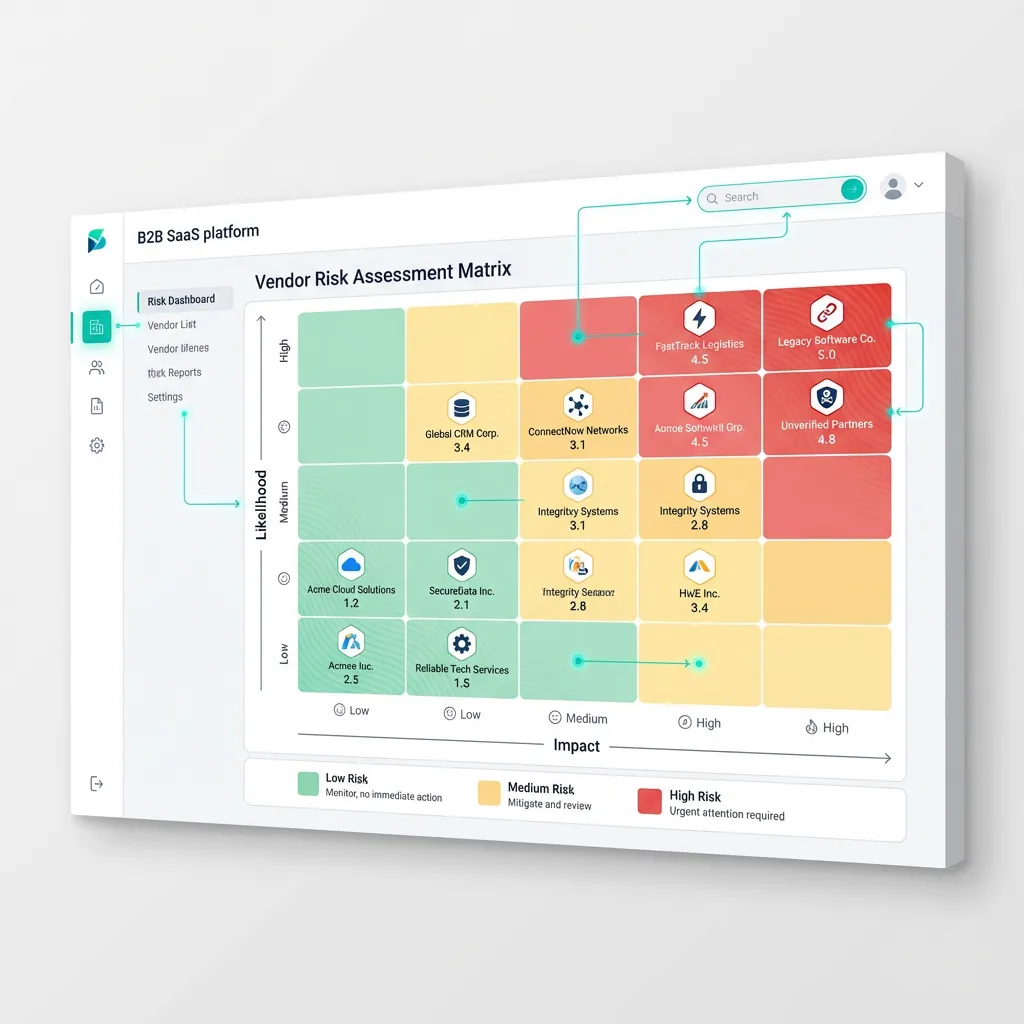

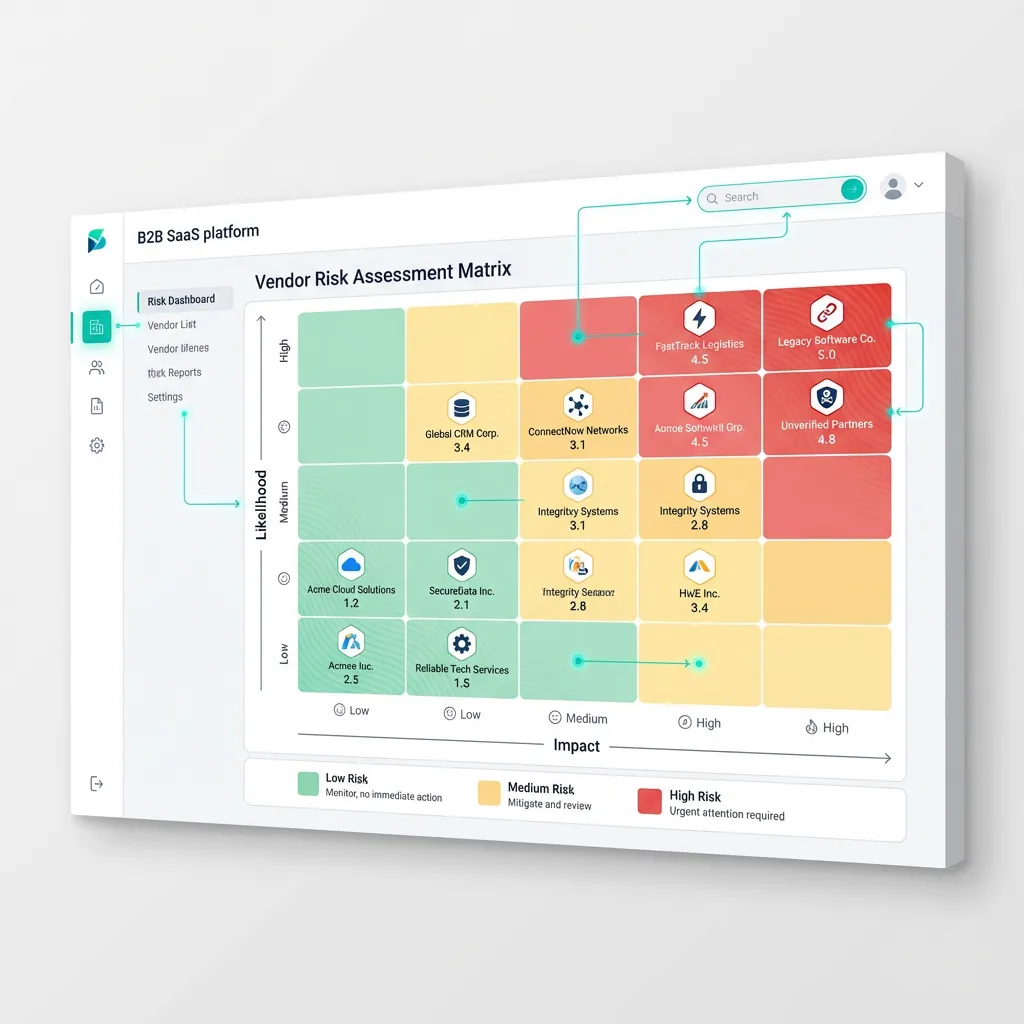

Step 3: Evaluate Risk

For each risk category, assess:

| Dimension | Scale |

|---|---|

| Likelihood | Low / Medium / High |

| Impact | Low / Medium / High |

| Combined risk | Likelihood × Impact |

| Mitigation available | Can risk be reduced? |

| Residual risk | Risk after mitigation |

Step 4: Risk Matrix

Map risks to action:

| Low Impact | Medium Impact | High Impact | |

|---|---|---|---|

| High Likelihood | Monitor | Mitigate | Avoid/Transfer |

| Medium Likelihood | Accept | Mitigate | Mitigate |

| Low Likelihood | Accept | Monitor | Mitigate |

Step 5: Document and Decide

| Decision | When Appropriate |

|---|---|

| Proceed | Acceptable risk, or with appropriate mitigation |

| Proceed with conditions | Contractual protections, monitoring required |

| Defer | Additional assessment or mitigation needed |

| Decline | Unacceptable risk, alternatives exist |

Risk Mitigation Strategies

Contractual Protection

| Protection | Purpose |

|---|---|

| Performance guarantees | Remedies for failure |

| Insurance requirements | Financial protection |

| Audit rights | Verification capability |

| Termination provisions | Exit without penalty if issues |

| Liability allocation | Clear responsibility |

| Compliance obligations | Explicit requirements |

Operational Controls

| Control | Purpose |

|---|---|

| Monitoring | Early problem detection |

| Performance reviews | Regular assessment |

| Backup suppliers | Alternative if vendor fails |

| Escrow arrangements | Access to critical assets |

| Transition planning | Exit strategy ready |

| Relationship management | Ongoing engagement |

Risk Transfer

| Method | Application |

|---|---|

| Insurance | Specific risk coverage |

| Indemnification | Vendor responsibility for damages |

| Guarantee/bond | Financial security |

| Parent guarantee | Corporate backing |

Cyber Insurance Requirements for Vendors

Don't just ask if they are secure; ask if they are insured.

What to Request:

- Cyber Liability Policy: Minimum $1M to $5M depending on data sensitivity

- Errors & Omissions (E&O): Covers their negligence causing you loss

- Breach Notification Costs: Will their insurance pay to notify your customers if they leak data?

Vendor Risk Assessment Checklist

Pre-Assessment Setup

- ☐ Business impact defined

- ☐ Data access scope identified

- ☐ Regulatory implications mapped

- ☐ Replaceability evaluated

- ☐ Assessment depth determined

Financial Risk Evaluation

- ☐ Financial statements reviewed (if available)

- ☐ Credit report obtained

- ☐ Payment history checked

- ☐ Revenue trends assessed

- ☐ Customer concentration evaluated

- ☐ Ownership structure reviewed

- ☐ Quick Ratio and Debt-to-Equity analyzed

- ☐ Risk rating assigned: ☐ Low ☐ Medium ☐ High

Operational Risk Evaluation

- ☐ Capacity for your requirements verified

- ☐ Quality certifications confirmed

- ☐ Key personnel identified

- ☐ Process maturity assessed

- ☐ Subcontractor dependencies mapped

- ☐ Geographic risks identified

- ☐ Risk rating assigned: ☐ Low ☐ Medium ☐ High

Technical Risk Evaluation

- ☐ Technology currency assessed

- ☐ Integration capability verified

- ☐ Scalability confirmed

- ☐ Documentation reviewed

- ☐ Technical expertise validated

- ☐ Roadmap reviewed

- ☐ Risk rating assigned: ☐ Low ☐ Medium ☐ High

Security Risk Evaluation

- ☐ Security questionnaire completed

- ☐ Certifications verified (SOC 2, ISO 27001)

- ☐ Data handling practices reviewed

- ☐ Incident history checked

- ☐ Subcontractor security assessed

- ☐ Privacy compliance confirmed

- ☐ Risk rating assigned: ☐ Low ☐ Medium ☐ High

Compliance Risk Evaluation

- ☐ Required certifications verified

- ☐ Compliance history checked

- ☐ Audit reports reviewed

- ☐ Contract terms address compliance

- ☐ Industry-specific requirements confirmed

- ☐ Risk rating assigned: ☐ Low ☐ Medium ☐ High

Reputational Risk Evaluation

- ☐ News/media search completed

- ☐ ESG factors evaluated

- ☐ Legal history reviewed

- ☐ Industry reputation assessed

- ☐ Risk rating assigned: ☐ Low ☐ Medium ☐ High

Overall Assessment

- ☐ All risk categories evaluated

- ☐ Combined risk level determined

- ☐ Mitigation options identified

- ☐ Residual risk acceptable

- ☐ Stakeholder review completed

- ☐ Decision documented

- ☐ Ongoing monitoring plan established

Frequently Asked Questions

How often should we reassess vendor risk?

| Vendor Type | Reassessment Frequency |

|---|---|

| Critical | Annually + trigger events |

| High-risk | Annually |

| Standard | Every 2-3 years |

| Low-risk | At renewal |

Also reassess when significant changes occur (ownership, financials, incidents).

What if vendors won't provide information?

Resistance to reasonable assessment requests is itself a risk indicator. Consider:

- What are they hiding?

- Can you work with limited transparency?

- Are there alternative sources?

- Is this vendor worth the uncertainty?

How do we assess vendors we've used for years?

Tenure provides performance data but doesn't eliminate ongoing risk. Conduct periodic reassessment because financial stability can change, security posture evolves, compliance requirements change, and management/ownership may change.

What's the minimum viable risk assessment?

For lower-criticality vendors:

- Credit check

- Basic reference check

- Contract protections

- Monitoring plan

Scale up for higher criticality.

Compare Vendor Capabilities Systematically

SpecLens helps you compare vendor specifications side-by-side, making it easier to identify capability gaps and assess technical risk before selection.

Compare Vendors →Assess Vendors Systematically

Vendor risk assessment protects your organization from preventable problems. Systematic assessment—matched to risk level—enables informed vendor selection and ongoing risk management.

Tags:

Related Articles

Vendor Scorecard Guide: KPIs & Templates

Stop guessing about supplier performance. Use our data-driven framework and 5 core KPI categories to build an effective vendor scorecard.

Vendor Selection Checklist: Key Criteria

Download our comprehensive vendor selection checklist. Evaluate suppliers on financial stability, technical capability, security, and culture.

RFP Response Red Flags to Watch

Learn to spot RFP response red flags that indicate vendor problems. Identify warning signs to avoid bad vendor selections.

Spec Compliance Verification Guide

Learn how to verify vendor specs actually meet your requirements. Systematic compliance verification for accurate procurement.